how are 457 withdrawals taxed

Your plan type will determine whether you qualify for a hardship or an unforeseeable emergency withdrawal while still employed. They differ in that 403b withdrawal rules are more like 401k withdrawals.

What Are Defined Contribution Retirement Plans Tax Policy Center

For employers the benefits are also clear.

. 27000 if age 50 or older 2022 annual limit of 20500. How does inflation impact my standard of living. This included the first RMD which individuals may have delayed from 2019 until April 1 2020.

How a 457b plan differs from a 401k plan. They have the ability to take payments as needed or request scheduled automatic payments. Are IRA Withdrawals After 59 Taxed As Income.

There is no tax penalty for this early withdrawal. The regular 10 early. Qualified retirement plans eligible for Rule 72t include the 401k 403b 457b Thrift Savings Plans TSPs and IRAs.

What are the tax implications of paying interest. However the combined deferral cannot. 27000 if age 50 or older In the 457 Plan you may choose to make pre-tax contributions andor Roth after-tax contributions.

Use this calculator to determine how long those funds will last given regular withdrawals. What may my 457b be worth. Like 403bs 401ks Roth 401ks Roth 403bs and traditional IRAs 457 plans have required minimum distributions RMDs.

Certain employers may offer both types of plans. A deferred compensation plan is another name for a 457b retirement plan or 457 plan for short. Further under the cost recovery method the taxpayer is required to remove his contributions first and then the untaxed portions.

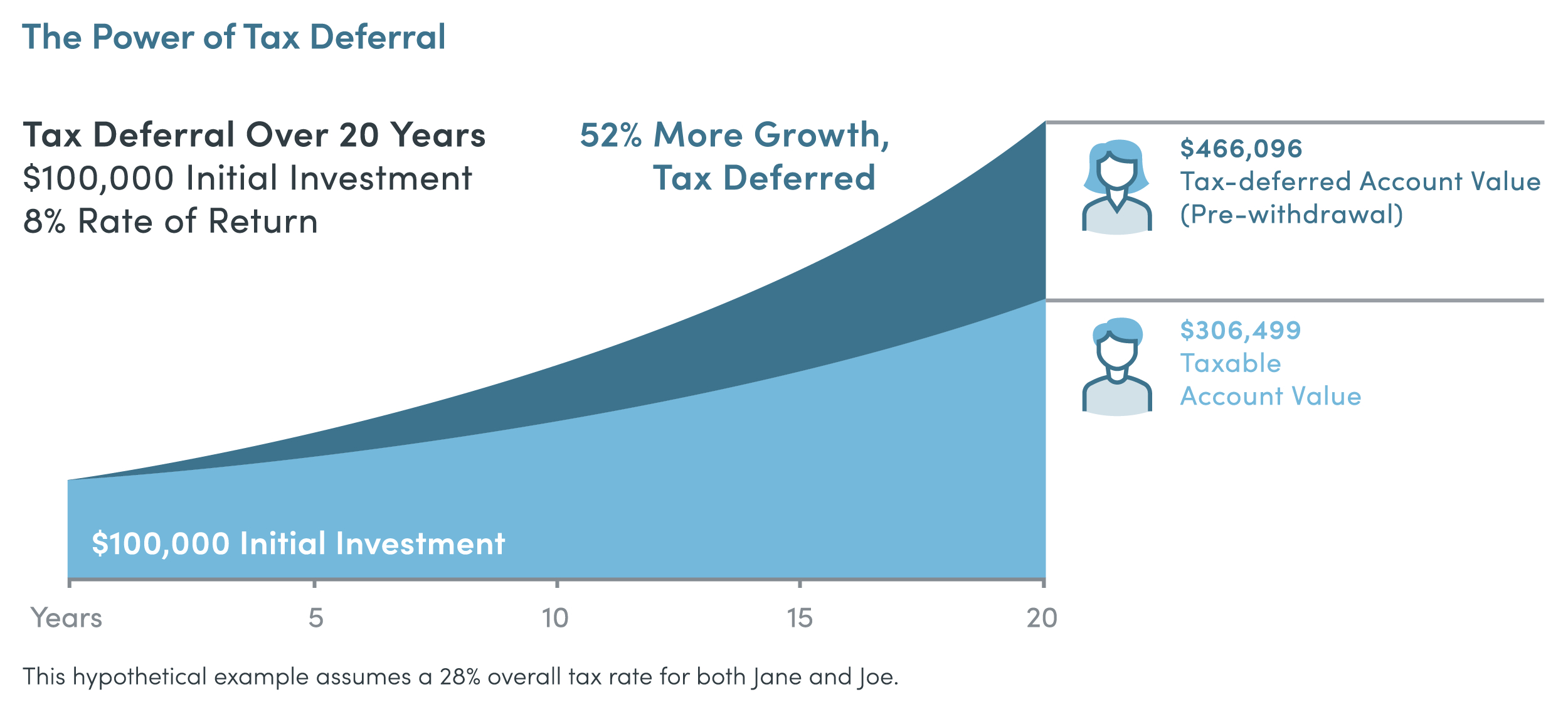

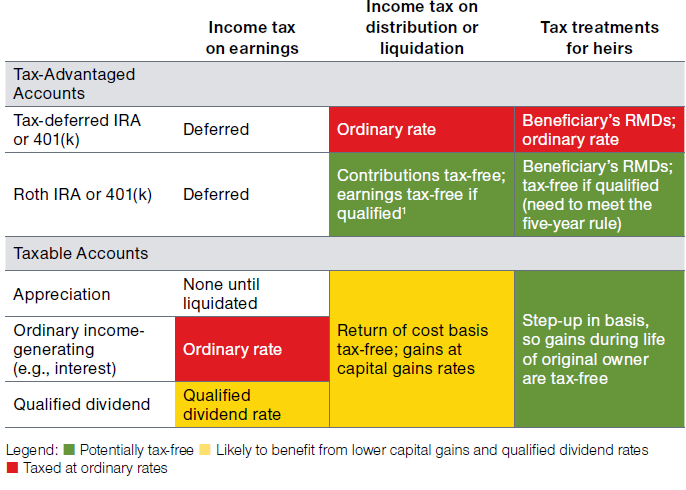

A traditional 401k grows tax-deferred with withdrawals taxed at your ordinary tax rate in retirement. That money and any earnings you accumulate are not taxed until you withdraw them. There are specific reasons outlined by your plan that permit withdrawals to help cover unexpected expenses.

27000 if age 50 or older 2022 annual limit of 20500. See Retirement Topics - Hardship Distributions. 401k plans are offered by private employers while 457 plans are offered by state and local governments and some.

As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew. A plan distribution before you turn 65 or the plans normal retirement age if earlier may result in an additional income tax of 10 of the amount of the withdrawal. How Are 457 Distributions Taxed.

Your plan may allow for loans and the limits for borrowing are the same as 457b plans. If you have rolled assets into. If the person tax 401k withdrawals and still works a job both income sources will be used to calculate the appropriate tax.

When you withdraw money from a 403b or a 457b in retirement youll pay taxes on those withdrawals though in some states retirement plan income is exempt from state income taxes. The 457b plan rules state that you dont have to pay a 10 tax penalty if you resign or retire before age 595 and need to withdraw money from your. Early Withdrawals from 457s and Roth IRAs Unlike other employer-sponsored retirement plans you can withdraw money from your 457 plan before the age of 59½ without incurring a penalty.

Offering a 457 plan can be used as part of a wider recruitment and retention strategy. Do 457 Plans Have Required Minimum Distributions. There is no set tax applied to 401k withdrawals.

27000 if age 50 or older In the 457 Plan you may choose to make pre-tax contributions andor Roth after-tax contributions. Complete the 457b. The money is taxed to the participant and is not paid back to the borrowers account.

The following COVID information was for 2020 Returns. IRS Information on the Withdrawal of IRA Funds. 401k withdrawals are taxed the same way the income from your job is taxed.

Using Rule 72t to set up a schedule of SEPPs is not a simple process. Withdrawals will be made proportionately pro-rata from your account money sources and your investment options unless you indicate otherwise on the Hardship Withdrawal Form. The tax rate that is applied to 401k withdrawals includes all income throughout the year.

457 401k Provision Pre-tax 457 Roth 457 Pre-Tax 401k Roth 401k Contributions 2022 annual limit of 20500. The biggest catch of 401k plans is a 10 penalty for early withdrawals on top of regular income tax. How to Handle 457 Funds After Retirement 2.

However the withdrawal will be taxed as ordinary income. Distributions from an IRA including a federal Roth IRA are taxable to the extent the distribution exceeds your previously taxed contributions. However the combined deferral cannot.

457 401k Provision Pre-tax 457 Roth 457 Pre-Tax 401k Roth 401k Contributions 2022 annual limit of 20500. The CARES Act passed in March of 2020 temporarily waived required minimum distributions RMDs for all types of retirement plans including IRAs 401ks 403bs 457bs and inherited IRA plans for calendar year 2020. 401k plans and 457 plans are both tax-advantaged retirement savings plans.

Employees can make withdrawals from their 457 account when they leave employment. How much of my social security benefit may be taxed. The 403b and 457b plans are both tax-deferred retirement savings accounts that cover nonprofit entities like governments churches and charities.

Although withdrawals are subject to ordinary income taxes 1. Youll pay a penalty tax if you withdraw funds before reaching age. Some employers offer a Roth 401k option.

Hardship withdrawals are typically available from 403b and 401k plans for the following reasons. What is the impact of increasing my 457b. This can result in withdrawals being taxed at the same or even higher tax rate than you had at the time of contribution.

The Hierarchy Of Tax Preferenced Savings Vehicles

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

Pin By Kimberlee Erickson Daugherty On Financial Freedom Types Of Taxes Financial Freedom Retirement Accounts

Retirement Income Calculator Faq

Income Tax And Capital Gains Rates 2020 03 01 20 Skloff Financial Group

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Is Alabama A Mandatory Or Elective Taxes 457 B Plan Ozark

A Guide To 457 B Retirement Plans Smartasset

Tax Consequences Tsp Withdrawals Rollovers From A Tsp Account Part 1

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

Capital Gains Tax What Is It When Do You Pay It

Make Saving For Your Future Less Taxing Security Benefit

How To Make Your Retirement Account Withdrawals Work Best For You T Rowe Price

Pin By Kimberlee Erickson Daugherty On Financial Freedom Retirement Money Investing For Retirement Traditional Ira

Pre Tax Vs Roth 401 K Contributions Youtube

2019 Us Year End Tax Planning Us Tax Financial Services

Hey Gig Worker Prepare For A Lot More Work When You File Your Taxes In 2022 Filing Taxes Tax Time Stock News